economics outlook 2012

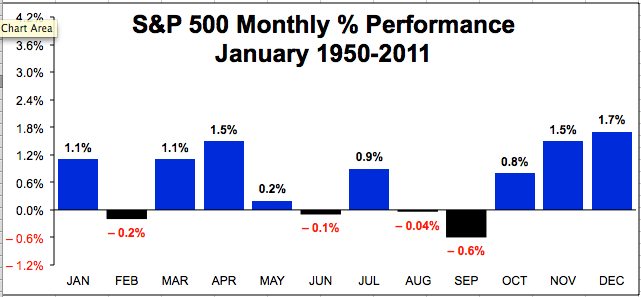

Market Minute: January 29, 2012: The "January Effect" and the probabilities for 2012

The 13 Januarys with returns of 3.75% or greater were in 1971, 72, 75, 76, 79, 83, 85, 87, 88, 89, 91, 97 and 99.

The average gain for the rest of the year was a surprising 19.6%. This means that if this January can finish above 1307.25, then there is a very strong probability of the index going higher in 2012. And as there are only two more trading days left this month, the US market would have to drop 10.77 points or more to cancel out the effect.

Bottom line: The S&P 500 has gained 4.44% in January. With two days remaining, the probability of a good performing 2012 is building. If the US index can close out the month above 1307.25, then there is a strong likelihood of another 15% gain by year-end based on 40 years of data.

Investment approach: The odds for a promising 2012 are mounting. If the S&P 500 does perform well, as the last 13 Januarys with a 3.75% would suggest, then investors may wish to remain fully invested this year to take advantage of the anticipated rise.

From an intermarket perspective, it is also worth noting what happens when the US markets moves up. The US dollar index and bond prices normally move in the opposite direction to the S&P 500. Commodities are closely coordinated with equities. If the stock market advances this year, so should base metal, gold, silver, oil and agricultural grain prices.

Also, there is a shift out of defensive sectors such as consumer staples, healthcare and utilities and a move to growth industries like technology, energy, mining, consumer discretionaries, construction and basic industry.

More research on commodities and the markets will be in the upcoming February newsletter.

Donald W. Dony, FCSI , MFTA

Dow Jones Shocking Prediction Forecast for 2012

Analyst Goldman Sachs predicts a major military developments in late 2012 and urges its clients to dump shares.

Last year Fox Business Channel for the first time publicly announced planned for the end of 2012 the great war. A former senior analyst and forecaster of the most influential financial services company Goldman Sachs, said a leading dumbfounded that his clients should begin to dump securities, as the military events of late 2012 would entail a major meltdown of financial markets. Anviktori published translation of the article Paul Watson, Infowars.com editor of this information megabombe, fell in a studio FoxBusiness network.

Massive conflict will cause the collapse of the securities market, strategic analyst forecasts Nenner. Yesterday, when the forecaster Charles Nenner told Fox TV (Fox Business network) about what the Dow Jones (Dow Jones) come down to the level of 5.000 because of major military events that shake the world in late 2012, Fox TV hosts David and Elizabeth MacDonald, Esma froze in shock.

Our economic outlook

by Troy Frerichs, CFA® Senior Investment Officer

one of my favorite professors of economy is PR Nouriel Roubini

article posted by google 18 june 2011

Debt Will Haunt the Market for Years to Come

Now, along comes New York University economics Prof. Nouriel Roubini, who sees a perfect storm of global events that could complete the down-the-tubes journey, not just for America, but for the rest of the global economy as well.

Among Prof. Roubini’s storm fronts is (1) a fragile U.S. economic recovery, coupled with a mushrooming debt, (2) looming economic problems in China, (3) debt issues eroding government stability in Europe, and (4) Japan’s moribund economy due to a crippling national disaster.

For those who never watched the film “The Perfect Storm,” it was a fictionalized version of a real perfect storm that stuck the U.S. Northeast coast in October 1991, when competing weather fronts clashed to create, well, the film’s title says it all — disparate forces coming together from different directions, making the whole much more devastating than the parts.

Roubini sees the global economic forces lining up for just such an event, possibly as early as 2013. In fact, sounding more like a Vegas oddsmaker than an economics professor, he insists the chances of a global collapse are one in three.

OK, he’s got our attention. But when you think about it, a one-in-three chance means there’s a two-in-three chance there won’t be a planet-wide economic meltdown. In gambler’s terms, that’s not so bad.

The problem is that the world’s decision makers continue to kick the can down the road, a point made in a Bloomberg Internet report on Roubini’s bold prediction, which provoked one ‘net blogger to opine:

“Ever feel like YOUR can is getting kicked down the road?”

He was referring to the public’s inclination to accept as fact the direst predictions from economists, turning a best-guess estimate into a full-blown, self-fulfilling prophecy.

There is one enduring fact about economists predicting future events — they usually give you the worst case, then mitigate the impact by offering various alternatives.

For example, Roubini seems particularly pessimistic about the future of the global economy — with his 33-percent chance of complete failure — while in the next breath he points out that, if the worst doesn’t happen, the global economy will continue to be anemic, but will be OK, or he can envision a scenario in which the global economy actually improves, considerably.

Like most economists, the professor is hedging his bets, which should make everyone feel better about the potential for a meltdown. Roubini was, however, the economist who first predicted, in 2006, a catastrophic global financial meltdown. Two years later, Lehman Brothers Holdings Inc. imploded, igniting the economic firestorm that sank the global economy to depths not seen since the 1930s.

So, what does all this mean? Are we to prepare for a perfect storm, full recovery or something in between?

Perhaps the answer lies not in the possible outcomes, but in the dynamics that compelled the good professor to wax gloomy in the first place — his belief that governments have been deferring the tough economic decisions for too many years, kicking the can down the road, a chain of events that has an inevitable doomsday feel to it.

The world has been on a spending spree for far too long, and Americans and their government are among the worst offenders. The bills are coming due, and we have no checks to put in the mail.

Over the past month, the economic newsflow has turned distinctly negative, particularly out of the U.S. Investors are now worried that the mark up in share prices in the early part of the year may have been overdone — stocks are effectively a leading indicator of economic output for the period ahead.

Nouriel Roubini, a New York University economics professor notorious for predicting the 2008 financial crisis, cautioned against risky investments.

"In the last month, things have changed, the evidence is that maybe this is not just a soft patch but something worse," he said in a speech in Singapore. "If your horizon is the next two or three months, I would be a bit defensive on equities...This is time to be cautious, and safe rather than sorry."

In Europe, the FTSE 100 index of leading British shares was up 0.2 per cent at 5,777, while France's CAC-40 rose 0.1 per cent to 3,809.22. Germany's DAX fell 0.1 per cent to 7,065. Trading activity in Europe was low as many countries, including Germany and France, were on national holiday though stock markets remained open for business.

Wall Street was poised for a lacklustre opening — Dow futures were up 0.1 per cent to 11,885, while the broader Standard & Poor's 500 futures rose an equivalent rate to 1,265.

Given the public holidays in many parts of Europe and a light economic calendar in the U.S., analysts were skeptical that stocks would gain any momentum over the day.

Tuesday may have more to offer, with Chinese inflation data likely to stoke concerns that the People's Bank of China will tighten monetary policy again soon. U.S. retail sales figures for May will also provide an insight into the state of the U.S. economic recovery — consumer spending accounts for around 70 per cent of the U.S. economy.

"All stock markets remain under pressure going into this week, and in the short-term at least, it is difficult to see the catalyst that is going to spark off a sustainable rally," said David Jones, chief market strategist at IG Index.

In the currency markets, investors continue to monitor any developments surrounding the Greek debt crisis ahead of next week's meeting of eurozone finance ministers in Brussels, where a fresh Greek bailout is on the agenda.

On Friday, the euro tanked amid signs that policymakers in Europe have divergent views on how to deal with the Greek crisis, with the European Central Bank and the German government at odds on getting Greece's bondholders to share some of the pain in helping the country.

Germany's finance minister Wolfgang Schaeuble has proposed that bondholders contribute a "substantial" portion of a fresh bailout package for Greece by giving the country an extra seven years to repay existing bonds. But European Central Bank president Jean-Claude Trichet has said nothing should be done that would be deemed "a credit event" by the ratings agencies and that any private sector involvement has to be done on a voluntary basis.

"A failure to achieve a workable agreement by the end of the eurogroup meeting next Monday threatens the real risk of what Schaeuble described last week as the first unorderly default within the eurozone," said Simon Derrick, senior currency strategist at the Bank of New York Mellon.

By late morning London time, the euro was up 0.1 per cent at $1.4355. That's three cents lower than the one-month highs it reached only last Thursday.

Earlier in Asian trading, Japan's Nikkei 225 dropped 0.7 per cent to close at 9,448.21 after the government reported that core machinery orders fell unexpectedly by 3.3 per cent during April. The drop came as companies cancelled orders following a devastating March 11 earthquake and tsunami in northeastern Japan that destroyed or damaged scores of factories.

The decline was the first in four months, evidence that the twin disasters continue to take their toll on Japan's economy. The seasonally adjusted figure includes heavily electrical machinery, engines, machine tools, road vehicles and aircraft but excludes orders for ships and utilities because of their volatility.

South Korea's Kospi closed 0.1 per cent higher at 2,048.74 while Hong Kong's Hang Seng Index finished 0.4 per cent higher at 22,508.08.

But mainland Chinese shares edged lower as market players reacted to data showing a dip in bank lending and awaited the inflation figures that could show the consumer price index surging to more than 6 per cent.

The Shanghai Composite Index fell 0.2 per cent to 2,700.38 after dipping more than 1 per cent earlier in the day. The Shenzhen Composite Index fell 0.2 per cent to 1,110.89.

In the oil markets, crude continued to fall on concerns over the global economic recovery and speculation that Saudi Arabia will decide to raise production levels despite last week's surprise decision by the OPEC oil cartel to maintain current levels.

Benchmark oil for July delivery was down $1 at $98.32 a barrel in electronic trading on the New York Mercantile Exchange.

____

Pamela Sampson in Bangkok contributed to this story.

go the dragon

go the dragon

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.