2013 Markets outlook DowJones

WILL MARKET RECOVER FOR END FY 2013

The Gold Report: As you noted in your last interview with The Gold Report in February, Goldman Sachs was predicting that gold would to go down to $1,200/ounce ($1,200/oz) in several years, and now “Dr. Doom,” Nouriel Roubini, says it’s going to $1,000/oz. What’s your view?

Chen Lin: In the near term, I think gold is being controlled by the paper market on Wall Street, which is unfortunate. However, I’m still bullish for the long run.

Trading Rules

DOW JONES WATCH FORECASTS

Best Six Months for Stock Market Are Underway Says Hirsch

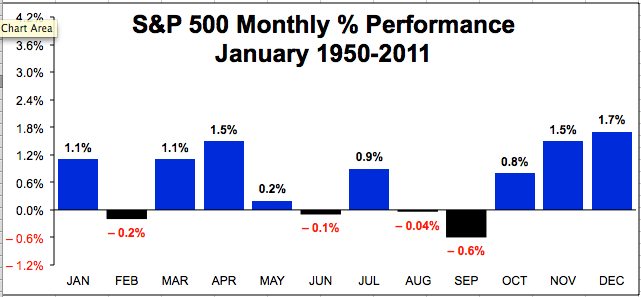

According to the Stock Trader's Almanac, November is the beginning of the stock market's strongest six-month period. The "Best Six Months Switching Strategy" goes like this: Invest in the Dow and/or S&P 500 between November 1 and April 30 each year, then switch into safer fixed income assets in May.

"We found that most of the market's gains are made from November to April, whereas you either go down or are flat from May through October; hence the sell in May and go away [strategy]," says Jeff Hirsch, editor-in-chief of the Stock Trader's Almanac.

Historically, there's a soft period from May through October, as seen in STA's chart below.

"We like to buy in October and get ourselves sober, even though we didn't get our trigger this year because the market was vacillating quite a bit," says Hirsch. He uses a MACD indicator as a trigger for buy and sell moves. Using the MACD, the DJIA's Best Six Months rises to an average gain of 9.3% versus a loss of 1.2% during the Worst Six Months.

On average as seen in the chart below, the Dow Jones Industrial Average has risen 7.5% during the Best Six Month period since 1950, versus 0.3% rise during the Worst 6 Months.

"Last year everyone was bearish — I was one of the lone bulls on the Street. I was really happy with our buy signal," says Hirsch. "This year I'm not so confident because the market technically is struggling against resistance; there are a lot of issues, there's a post-election year coming up, there's fiscal cliffs. So we're going in with tighter stops with our trades this year."

Needless to say, November is off to a very weak start with the DJIA, S&P 500 and Nasdaq all down over 4% month-to-date. Hirsch has already warned of risk in 2013 based on the election cycle and historical weakness when an incumbent president is re-elected.

"Again, we're at the sour spot of the four-year [presidential election] cycle," he admits. "We'll make our trades, but we'll be a lot more cautious and keep the stops a lot tighter instead of leaving it wide open here."

If this is as good as it gets, maybe that's a sound warning for the year ahead. How are you positioning for 2013? Let us know in the comment section below or visit us on Facebook!

More From Breakout:

SPECIAL REPORT THE BULL ARE BACK 2012

DOW SIGNALLING A TOP 12800 CORRECTION

STOCK ALERT

Markets are constantly in a state of uncertainty and flux ... money is made by discounting the obvious and betting on the unexpected'

~G. Soros

The biggest risk in life is not to have one.

Investment Watch Blog

Australia Penny Shares companies are managed by the worth CROOKS of the system,, most of it wheeling and dealings to clean the holders?? most of them are INsiders/ traders.. ACCOUNTANTS AND CORPORATES LAWYERS,, protected by ASIC

Shame on them >> TRADE WITH THEM >> DO NOT HOLD THEM>> i call them professionals criminals THEY ARE DESTROYING PEOPLE WEALTH

AS 4 November 2011 MARKETS SENTIMENTS BULLISH see updated forecasts chart... DOW TESTING 11400 support, Warning

*********************************************************

TARGET DOW 10400 - SP500 900 long term

go the dragon

go the dragonTAKE NOTE THAT THE mARKET SEEMS TO CONSOLIDATE FOR A TURN ??? bIOTECHS SEEMS TO WARM UP??

accumulation on the penny shares,, be aware of consolidation

our chart updates support 1

CHARTING STUDIES

dow new chart formation warning

very important level to watch.. be aware of a dip

BEWARE OF CORPORATE CON MAN AT WORK

elliott wave blog

THE ART OF STEALING FROM SHARE HOLDERS

just playing with your money

link to ART OF STOCKS MANIPULATIONS

Quote of the day: note that in this market company directors keep very low profiles?? 6 months ago they were flooding the market machine with intentions??

signs of the time?

Dowjones future forecast

ASX TAX SELLING ending soon Watch the bounce

we may have a surge?

technical speculator page

VIX reverse sharpely

VIX reverse sharpelyTAX adjustements done??.Happy New Year?

2012 could be a slow start /pending DowJones correction?

the words are Correction.. recession ... and fears of Depression

MOST DIRECTORS ARE ROBBERS ON ASX

Dowjones in correction mode.>> next support?? correction = recession = depression ?? 3 support scenario possible?

Astute accounting taking place

link to cycles theory

WARNING SIGNALS GIVEN ON THE RISING FLAG (3 months periode)

Quote of the moment??

Buying time is upon us.... Everone is getting more and more fearful which leads me to think we are getting closer to this downturns bottom. I'll be buying more as funds free up.

Saturday, January 15, 2011

GOLD and the PennyShares

GOLD CYCLE

my previous top was at 1420.. at 1500 i see it as a

super top, let' compare to some previous tops

look at the chart

correction is in the making

Lessons from Prior Gold Tops

By Parker Binion

April 24, 2011

The precious metals rally that began in July-August of 2010 looks very similar to the bull runs in gold and silver in 2005-06, and 2007-08. Let’s examine what happened at the end of those bull markets for clues on how to play the expected top in metals coming in the May-June 2011 time frame.

Here’s the end of the 2006 bull run:

have a look at this TTR

a weekly chart,

all criterias are filled??

is it a top???

END OF GOLD RUSH ??????

TTR weekly chart

Gold as 9 june 2013

ReplyDeleteGold is busting ??

see article from Roubieni

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More...)

On June 3rd, Nouriel Roubini published an article that gained a lot of attention, where he predicted gold prices to reach $1000/oz by 2015. As the observant reader will notice, he is far from the only one being bearish on gold. As a matter of fact, his views seem to be shared by a majority of opinion leaders and investment banks.

So, will Nouriel "I predicted the financial crisis" Roubini be correct about his gold price predictions? The arguments he is providing can be summarized as follows:

1. Serious geopolitical financial risk has subsided and gold as a "fear trade" has fewer triggers

2. Inflation has remained low in spite of massive monetary easing

3. Gold earns no income

4. Interest rates will rise (increasing the alternative cost of holding no-income assets)

5. Central banks of highly indebted nations (such as Italy) may need to liquidate their gold holdings

6. Gold has been over-hyped by conservative American politicians

Just like most research published by Roubini, his analysis is highly superficial, and just in line with the mainstream view (sorry Nouriel, you were not the only one, and definitely not the first one "predicting the financial crisis").

That does not necessarily mean he will be wrong about his prediction, even though (as I will elaborate on below) his arguments are flawed. Like for any investment asset (be it gold, stocks or real estate) current price formation is determined by the public's expectations about future prices. If the majority of market players expect the price to go to $1200/oz, then the price will go to $1200/oz, as buyers will hold off their purchases in anticipation of a price decline, and sellers will continue selling as long as the price is above what they expect it to become in the future. By singing soprano in the choir of gold bears, Roubini is influencing the price expectations of the public and contributing to a potentially self-fulfilling prophesy.

page 1 / 2| Next »

About this article

Emailed to: 273,622 people who get Macro View daily.

Author payment: $0.01 per page view, with minimum guarantee of $500 for Alpha-Rich articles plus free access to Seeking Alpha Pro.

Become a contributor »

Tagged: Macro View, Gold & Precious Metals

Problem with this article? Please tell us. Disagree with this article? Submit your own.

Share this article

Short URL: 0

inShare

BigBearShort

Articles (1)

Comments (9)

Profile

1 Followers

0 Following

Follow

Send Message