DowJones market update as 17/06/2011

Dow Jones Rebounds 64 Points Amid Better Economic Numbers, 17-06-2011

Dow ended 64 pts higher at 11962 in a choppy session, as investors are veering between the debt crisis in Greece and U.S. economic data (i.e. lower weekly jobless claims and rising May housing starts) that offered some respite.

Sentiment also improved after the IMF vowed to continue to support Greece, and anticipating a “positive outcome“ at the next meeting of euro-zone leaders.

After the bell, Research In Motion reported weak 1Q results and slashed its full-year earnings forecast, signaling continued weakness in the company’s line of BlackBerry smartphones.

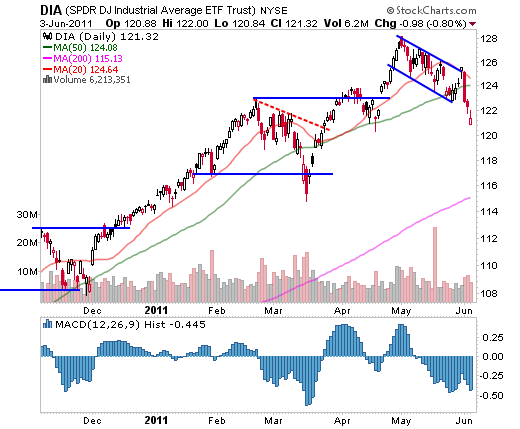

Daily Dow Jones Shows No Concrete Signs Of Sustainable Rebound

DowJones market update 05/06/2011

charts readings : top of wave 3 given at 12800 Flag TOP first support on the monthly chart is 10200 a correction was imminent : change of cycle= change of sentiment= all in the process??? see previous chart signals

in 2009 we saw a correction of 50 % 14000 to 7000?

a more conservative correction of 30 % would give us correction 3840 = 9000

then we will be looking for the support channel on the 20 years chart beetween 8000 and 10000

all economics indicators are very negative saying the market need a purge or correction?

so for this time and keeping in mind USA election cycle in 2012 we are waiting for the first target of <10200 to be achieved >

to be posted

1 year chart 6 waves to top W6 = correction back to W2 W1 10200

5 year chart 6 waves down 6800 in 2009 + 6 waves up to top 14000

T Ttheory formation

support W2 10000 - support W1 8500

20 year chart 6 cycles up correction to Cycle 1 = 8200 Cycle 2 = 10200

trend line projection about 9000

click on images to enlarge

Dow 25 years chart

|

|

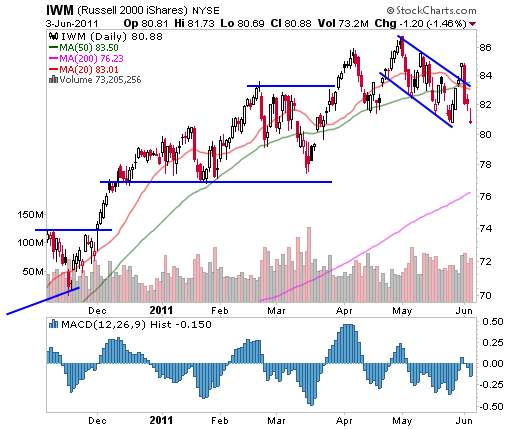

While the markets have been sending mixed signals recently, there was no mistaking this week’s action. The markets reversed sharply after a weak breakout attempt and are back to multi week lows. They are also mired under their 20 and 50-day moving averages after falling on increased volume. The market certainly appears to be topping out as we head into the summer trading season, although I hesitate to say it due to the weekly chart still showing an uptrend. In either case, what is important for traders is to realize that the environment is fraught with risk right now. There are times when it is better to reduce exposure to the markets and wait patiently for the markets to give you an opportunity. This is likely one of those times. If you are still holding several positions, make sure it is because you have a specific plan you are following and not because you are stuck and unwilling to take a loss. If the markets have a full fledged correction, its possible that much lower prices can be seen fairly quickly. Next week will surely shed more light on where we stand.

Bull or Bear Markets

Market Trend

"The trend is your friend" is one of those Wall Street axioms that make sense to follow. After all, the trend of the overall market determines approximately 60% of the performance of a stock. In fact, the market trend is the most important factor to consider in your investing analysis. Accurately gauging the market is not a matter of luck. The transition from a bear to a bull market creates many of the best investing opportunities. Fortunately, there are telltale indicators that can help you identify bull and bear markets.What do you look for to identify a change in the trend of the market? First, it is best to keep the method simple. Second, the market tends to anticipate changes in the economy by up to six months. Therefore, we cannot look to the economy to get our warning signs. Fortunately, there are ways to interpret the psychological behavior of the market using several proven technical analysis indicators.

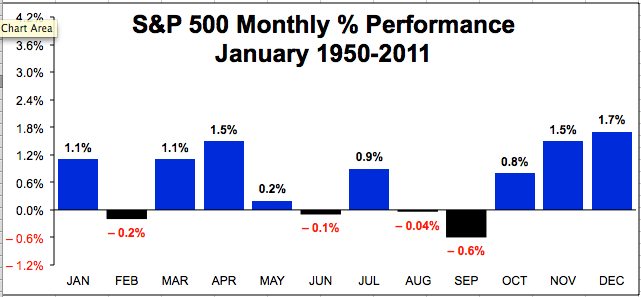

The chart below displays the S&P 500 index for the last 20 years. Professional traders and investors use the S&P 500, as it is a much better representation of the stock market than the DJIA, which is what the talking heads on TV quote.

Starting at the top of the chart, the RSI or Relative Strength Indicator signals a transition from a bull to a bear market when it falls through 50. When the RSI crosses up through 50, it signals a bull market is underway.

The RSI compares the magnitude of a stock's recent gains to the magnitude of its recent losses and turns that information into a number that ranges from 0 to 100. When the sizes of gains outnumber losses, it moves up. Should the size of losses outnumber the size of gains, it falls. The idea is to measure the underlying strength of the market. If there are more days moving up and the size of the move up is larger than the size of the move down, the market is moving up and so is the indicator. The same holds when moving down. As a result, the RSI tells you whether more investors are buying. When it turns down through 50, it is telling you that there are fewer buyers, indicating the market is more likely to go down.

Notice the horizontal blue line at the market top in 2000 and again in 2007. Often highs like the one in 2007 offer resistance to a market that is moving up. Investors who owned shares of stock at a former high tend to sell those shares when they finally reach the high again, seeking to get out with their money. This selling pressure overcomes the buying volume and the market turns down. When this takes place, it is another sign the market is turning from a bull to a bear market.

The 24-month Exponential Moving Average (EMA) offers a good indication of the transition from a bull to a bear market and back to a bull again. When the S&P 500 falls through the 24-month EMA, it is a sign that the up trend is reversing. When the market is above a moving average, it tells you that there is more demand for stock. On the other hand when the market is below the moving average, it indicates that there is less demand for stock. This change in demand for stock is a major force in driving the market up and down. Knowing when this change takes place helps to define when we observe the transition from a bull to a bear market and back again.

Often a trend line forms that defines the direction of a stock or the market. On the chart below, an up trend began more than 25 years ago. In the recent bear market, this trend was tested as the market fell precipitously. However, it held and the market rebounded. In this case, the trend line does not describe a bull or bear market. Rather it tells us that there was a good chance that buying volume would overcome the selling volume and the market would stop going down.

Going further down on the chart, we come to the MACD or Moving Average Convergence Divergence indicator. When the MACD turns down through the 9 month moving average it is sign the S&P 500 is about to turn down. On the other hand, when the MACD rises through the 9-month average, it is a sign the S&P 500 is turning from a bear to a bull market. Our article on the MACD Indicator provides more information on this useful technical guide.

At the bottom of the chart, we find the Slow Stochastic, another indicator useful to identify bull or bear markets. For this indicator we use a 60 period %K factor. When the Slow Stochastic falls through 80, it is a sign of a bear market. The Slow Stochastic gives a buy sign, when it rises through the 20 level, it gives a sign a bull market is beginning. Our article on the Slow Stochastic provides more insight on how to use the Slow Stochastic Oscillator.

Another Bull Bear Indicator

Since the chart above is a monthly chart, it can delay the signal of a new bear or bull market. Fortunately, there is a way that works with the daily chart to give you early warning that the bear market might be over. It turns out the 150-day Exponential Moving Average (EMA) provides a good way to identify that a new bull market has begun. When the 150-day EMA flattens and then turns up, it is a good signal that the bear market is over and a new bull market is beginning.The chart below shows the end of the bear market in early 2004. Once in 2003 and again in early 2004, the market rallied and the 150 EMA flattened. In each case, the market turned back down. In addition, the 150-day EMA only flattened, as it did not turn up.

In April 2004, the 150-day EMA flattened and then turned up, signaling an end to the bear market and the beginning of a new bull market. This approach provides investors another way to logically identify the bear to bull market transition.

Charts courtesy of Stockcharts.com

Investors who are on the right side of the trend will beat the market. The technical analysis offered provides a good way for investors to participate in the bull or bear market trends. Once you can identify the bull or bear market trend, you can then invest with confidence that the market is on your side.

I also encourage you to read Market Cycles, as it describes the major cycles the market tends to experience. By the way we use these technical indicators for many of our analysis of the market indexes, stocks, and Exchange Traded Funds (ETFs).

VIX CHART

Healthy VIX levels ... for now.

Today's chart show's the Volatility Index (VIX) and its action back to January 2010.

Note what has happened to the VIX since May of 2010. After reaching a peak level last May, its has continuously made lower/highs and lower/lows ... the definition of a down trend.

Since the VIX moves opposite to the stock market, this has been a bullish sign. Currently, the VIX is below a level of 20, and below fan line number 5 which is currently a positive bias condition.

Now, take a moment and look far to the right where you can see the three trend lines converging on each other. A critical, apex intersection will occur before the end of February. Why is that important?

Because that is where the odds are very high for a pattern breakout ... and that could happen in the next few weeks, or next month. When it happens, the odds are for an upside breakout on the VIX which would be a negative for the market at that time ... so start putting the VIX on your radar if you haven't done so already.

*** Feel free to share this page with others by using the "Send this Page to a Friend" link below.

go the dragon

go the dragon

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.