The great Australian superannuation fraud

By Alex Messenger

16 August 2010

Returns on Australian compulsory superannuation savings, a scheme sold to workers as a substitute for the old-age pension, have barely surpassed the rate of inflation over the last 14 years, according to official figures compiled by the government-funded Australian Broadcasting Corporation (ABC). These figures are proof that the superannuation system, which Labor and the trade unions proclaim as their “proudest achievement”, is one of the greatest swindles in Australian history.

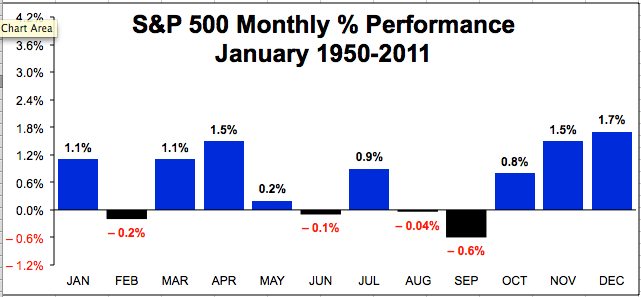

According to the ABC’s compilation of figures released annually by the Australian Prudential Regulation Authority, the average annual return on superannuation investments between 1997 and 2009 was just 3 percent, as compared to an inflation rate across the same period of 2.8 percent. Taken over past decade, superannuation funds have returned less than the inflation rate—meaning that workers would have been better off simply putting their money in the bank.

The figures are partly explained by market volatility, especially the huge losses during the initial stages of the global financial crisis, and by poor investment decisions on the part of superannuation funds managers. Just as importantly though, the risible returns are all that is left over once investment advisors and fund managers, including trade union bureaucrats, take their hefty slice. A staggering $A17 billion in fees—or $48 million per day—is siphoned off each year from workers’ savings. As the ABC pointed out, this sum alone would be sufficient to fund the entire Australian old age pension system. Yet none of the major parties—Labor, Liberal or the Greens—has commented on these extraordinary figures during the current election campaign, much less on the question of old age incomes more generally.

Compulsory superannuation, introduced by the Keating Labor government in 1992, involved an obligatory employer contribution of 3 percent of each worker’s wage to superannuation funds, which would then be invested in Australian securities, especially the stock market. The chief aim was to transfer a large pool of capital into Australian investment banks, which would then be in a position to punch above their weight on the global stage. In other words, there is a direct link between Labor’s super system, the refusal of successive governments to increase the poverty-level old-age pension and the increasing financialisation of the Australian economy.

The trade unions were involved from the outset. The scheme was a key plank of the “Accord” reached by trade unions and the Labor government to suppress real wages, boost “international competitiveness” and end worker militancy. Union leaders are now involved in the management of superannuation funds worth billions of dollars and thus have a direct stake in ensuring the ongoing implementation of pro-market policies to boost the financial markets.

By 1996 the employer contribution rate had risen to 9 percent. However, with the assistance and support of the unions, this levy was compensated by the abolition or reduction of wage increases. In other words, the compulsory employer contributions were, in effect, paid by the workers themselves.

By 2010, the Australian superannuation pool had risen to $1.17 trillion, making Australia the largest per capita holder of superannuation funds in the world and the fourth largest in gross terms. The figure is equivalent to 100 percent of GDP. Superannuation funds own 26 percent of shares on the Australian stock exchange. As part of Labor’s original deal with the unions, about a quarter of the superannuation pool is controlled by the unions in so-called “industry” superfunds.

In this year’s budget, handed down in May, Labor promised the unions and the finance industry that it would increase compulsory superannuation contributions from 9 to 12 percent of wages by 2019. In line with the current model, then Prime Minister Kevin Rudd invited employers, at the time of the budget, to take the new super impost “into account when negotiating future wage agreements”. According to Labor’s estimates, a further 3 percent increase in super contributions will add $85 billion to Australia’s superannuation pool in the next decade, and more than $500 billion by 2037. The stakes for Australian capitalism in maintaining and expanding the current superannuation system are therefore huge. Finance sector research company Rice Warner estimates that within 15 years, total superannuation holdings will have increased to $A2.7 trillion.

According to Jeff Breshnahan, head of superannuation research firm SuperRatings, the bulk of the $17 billion from compulsory super investments—about $9 billion—goes to well-paid investment managers, whose salaries are, even by finance industry standards, “incredibly high”. As Mike Rafferty, a researcher at the University of Sydney points out, “average wage and salary earners…are subsidising massive salaries that go to fund managers.”

Moreover, fund managers receive these huge salaries regardless of whether their investment decisions increase or reduce workers savings over the course of a given year. Their pay is calculated not on return rates, but on the size of funds under management. Because 9 percent of workers’ wages will roll into the share market regardless of market performance, management salaries are guaranteed. Further, as the ABC pointed out, the vast bulk of the $1.17 trillion super pool is made up of contributions, not of returns on investments. Contributions have been boosted by a series of tax concessions engineered to make superannuation a superficially attractive investment for higher income workers. Prior to the eruption of the global financial crisis in 2007-08, tax incentives introduced by the Howard Coalition government caused a sudden exodus of household assets into super funds. Some $381 billion, about a third of the total $1.17 trillion super pool, was added in the years 2005 to 2007.

The most powerful indictment of the compulsory superannuation system is abundant proof that most workers will still be dependent on the poverty-level pension in their retirement. In other words, despite contributing 9 percent of their wages to Australian superannuation funds, and thus the stock market, every week for the past 15 years, most Australians still have superannuation accounts of less than $70,000. As former Prime Minister Kevin Rudd admitted earlier this year, “a low-income earner on half of average weekly ordinary time earnings [that is, on $31,000 per year] would expect to be 80 percent reliant on the age pension after retirement.”

The solution put forward by the superannuation industry, government and the unions is not to increase the aged pension—which has continued to fall in real terms over the last 20 years—but to increase the retirement age for eligibility for the pension. Under plans unveiled by Labor in the 2009 budget, the Australian government will increase the pension age from 65 to 67 in 2019 —the first increase in the male retirement age since aged pensions were introduced in 1909. Given business demands for budget austerity, the proposed change could well be brought forward. Treasurer Wayne Swan said earlier this year that unless the pension age was increased substantially, society could not afford to look after its elderly: “The blue-collar workforce is impacted upon by the stress on their bodies over time, I openly acknowledge that. But what we have to do is go back to basics here… if we don’t make these changes, the system may not be viable.” Given that the amount siphoned off in superannuation fees could pay for pensions, the statement is a complete lie. Swan’s comments underscore the degree to which he, the Labor government and the whole political establishment is in the thrall of big business—more specifically, of the powerful finance sector—that participated enthusiastically in the worldwide speculative orgy that precipitated the current global economic crisis.

Click here for full coverage of the SEP 2010 election campaign

Authorised by N. Beams, 307 Macquarie St, Liverpool, NSW 2170

go the dragon

go the dragon

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.