America sneeze = the world catch the flu

that an old saying...

will they survive??

the battle is on

i do strongly believe in American imperialism.

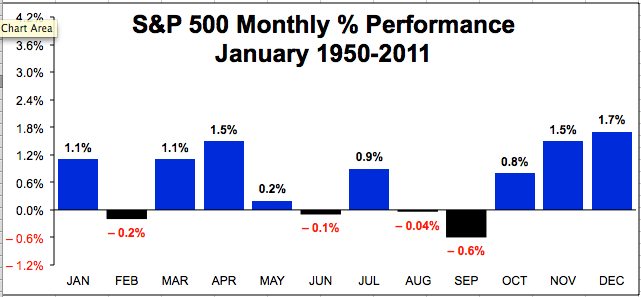

ELECTION YEARS CHART

| Chart of the Day |

Notes:

- Where's the Dow headed? The answer may surprise you. Find out right now with the Barron's recommended charts only available at Chart of the Day Plus

| Why China Risks Repeating an American Disaster Monday, 27th June 2011 Melbourne, Australia By Kris Sayce

.............................................................................................................................................................................

............................................................................................................................................................................. In today’s Money Morning: Low debt and high savings... Australia in the wrong corner... Production to consumerism - and the risks involved... Uranium, gas or something else... Why China Risks Repeating an American Disaster "The strength of the real-estate market directly affects the construction, steel, concrete, power and appliance industries. In all, about 50% of China’s GDP is linked to the fate of its real-estate market, according to Standard Chartered economist Stephen Green." - Wall Street Journal The debt problems in Greece are nothing compared to the China Problem. At first glance the numbers suggest China is in top shape. Take this chart we found: Low debt, high savings In terms of debt levels you want to be in the lower part of the chart. That’s where China is. Where you don’t want to be is the top right corner... that’s where the Anglo-Saxons are - Australia, the U.S. and the U.K.And for savings rates, you want to be towards the top... again, where China is (although Singapore is in the best position at top right). And the spot to avoid is the bottom part of the chart... again where the U.S. and U.K. are. And where Australia is headed. But here’s the problem... China only has low debt levels because Western economies have high debt levels. And China only has a high savings rate because Western economies have a low savings rate. Which is fine... for a while. But when your customers run out of credit and can no longer spend, what does a business do? How to become a consumer nation The argument in the mainstream is that China will just start buying its own stuff. It will become a consumer nation.But how will it do that? At the end of 2010, China had the equivalent of USD$2.85 trillion in foreign reserves. Of that, USD$1.16 trillion was invested in U.S. government bonds. In other words about 40% of China’s wealth is held in U.S. dollar denominated debt. The problem for China is if it wants to become a consumer nation, it needs to get rid of those U.S. dollars. And that’s China’s biggest problem. First up, selling U.S. dollars will devalue those it still holds. It’d mean China getting less Yuan for their dollars than they’d hoped. And that means less cash for consumers. The idea that becoming a consumer nation is the solution is ridiculous. As with most poorly thought out solutions, it only appears to work in the short term. Think back to what we said earlier. If a major customer stops spending, what will that do for a bus iness? That’s right, it spells trouble. Even if previous spending had built a big cash reserve. So unless the business can find new customers it will need to use savings. According to the mainstream, that’s just what China needs - start spending everything it has saved. But think about that in a business perspective again. Would it really make sense for a company to blow the budget on expenses at the same time as it lost its main customer? Of course not. Not if the company wants to remain viable in the long run. What it really needs is to find more customers. Why China will face the same problems as the U.S. For instance, think how consumption policy has worked in the past. It’s exactly what the U.S. started doing 50 years ago. It started buying everything it produced... and then more... using credit.Even being the world’s largest manufacturer wasn’t enough to save it, be cause it consumed more than it exported. But that’s exac tly the policy China is set to follow. And it’s being cheered on by the West. Having run out of customers, instead of cutting back on production, the central planners and Westerners think the best idea is to have China spend its savings. As you can see from the charts above, there’s plenty to spend. But when you combine falling exports with higher spending, it won’t take long for China’s position to reverse. What will that mean for Australia? Funnily enough, it could mean Australia’s status as the "Lucky Country" gets one more stroke of luck. It could mean China’s demand for resources continues as it becomes a consumer rather than an exporter nation. But don’t jump for joy yet. Even if the Chinese consumer fills the gap left by Western consumers, the transition won’t be smooth. Yes, China may keep the Australian economy afloat a while longer, but you shouldn’t fall fo r the mainstream spin that it’ll be painless. Cheers. Kris Sayce Money Morning Australia A Threat? Or an Opportunity? By Aaron Tyrrell, Editor, Money Morning Nine out of 10 households have been promised tax cuts, pension increases and a boost in family payments to help cope with the increased cost of living under the carbon tax. Nine out of 10 households?! That means somewhere around eight million taxpayer-funded bribes will be handed out... to Aussies with a household income of less than $150,000... to cover the cost of the new tax... No wonder poll results in the Sydney Morning Herald reveal the carbon tax is more hated than ever. Now you should take poll results with a fistful of salt. But it doesn’t matter. The carbon tax WILL come in, in some form, no matter who has the powe r. So it’s time to stop griping and start looking for opportunities. According to Diggers & Drillers editor, Dr Alex Cowie, uranium stocks could be back on the up as we move into the second half of this year. Why? Well, all the fuss about these carbon belchers could leave the door ajar for uranium to trumpet its case as the clean, green and reliable alternative to dirty coal. (You can read what Alex had to say in full in the Daily Reckoning here.) Although it may take a while to shake off the Fukushima blues. If you want an example of how uranium stocks have fared since the Japan crisis, the following three stocks have dropped an average 45.53%: PepinNini Minerals Ltd (ASX:PNN), U3O8 Ltd (ASX:UT O) and Thundelarra Exploration Ltd (ASX:THX). Are any of them any good? We don’t know. But they’re cheap. The priciest will set you back less than 30 cents a share. Although Australian Wealth Gameplan editor, Dan Denning would argue there’s good reason for that. In an advanced note to the special report he’s due to release, Dan said the Age of Oil will give way to the Golden Age of Gas. That seems to make sense. Gas is proven and compared to nuclear energy, low cost. Or maybe you should forget energy and start looking for other opportunities. Money Morning reader, Geoff W. wrote in last week to point out property developers could be set to double their money at a carbon price of just $10 a tonne. I’m still looking into this story - it seems to be buried under piles of clauses, bullet points and addendums in pa rliamentary papers - and will let you know what I find... More to come... but it wouldn’t be the first time property developers have come up with an excuse for why property must double! Aaron Tyrrell Editor, Money Morning PS. Dan’s special report on oil, natural gas and the Middle East is due any day. Keep an eye on your inbox over the next few days. In our view it could be the most important piece of research you read this year... Related Articles Why You Shouldn't Buy China Which Commodity is Set to Take Off Next? Is It Time to Buy This Unloved Energy Play? The Petro Dollar Standard in Crisis Why I'm Flying the Flag for China From the Archives... Why This is a New Golden Age for Energy Stocks 2011-06-24 - Kris Sayce The RBA Strums While the Australian Economy Burns 2011-06-23 - Kris Sayce Beware the Sub-Prime Food Market 2011-06-22 - Kris Sayce Is OPEC Following Michael Corleone's Advice?< /strong> 2011-06-21 - Kris Sayce The Depression You Better Hope We Have 2011-06-20 - Kris Sayce For editorial enquiries and feedback, email moneymorning@moneymorning.com.au | .......................................................

....................................................... ....................................................... "Multiple chances to spin grubstakes into 'dream hauls' in the time it takes to need a new haircut..." Slips tream Trader Murray Dawes is going to deliver a whole new calibr e of short-term, higher-risk, greater-return trades on TOP of his regular trades. You should only trade these alerts if you have a very high risk tolerance. To learn more about how Murray is going for triple-digit gains inside three months, watch this video presentation. ....................................................... ....................................................... The secret deal that rig ged global silver prices - and one Aussie stock set to benefit... How a silver price manipulation scandal, a hit-and-run accident and a courageous whistleblower have handed you the chance to capitalise on the silver boom - before prices surge again in 2011. For full details click here. ....................................................... |

go the dragon

go the dragon

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.